The year is 2014: Europe is stumbling from one emergency summit to the next. America has gone crashing through the 15-billion-dollar debt ceiling. People are taking to the streets across the world because they have realized that something has been thrown off kilter; that the market economy is tearing a vast rift between the super rich and the masses; that the banks have spiralled out of control; that governments have lost their grip on public debt.

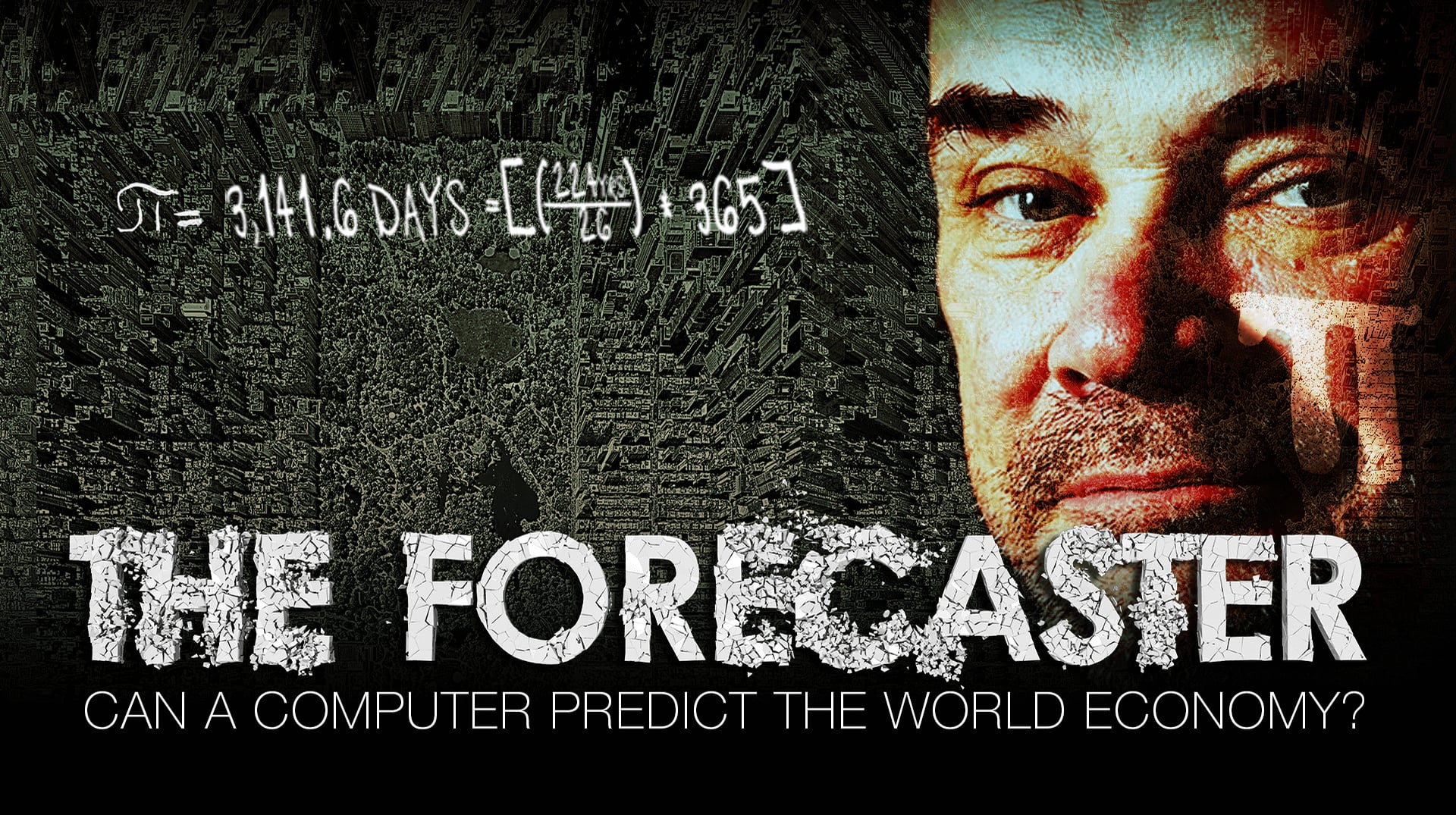

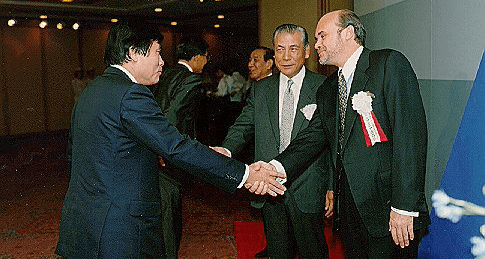

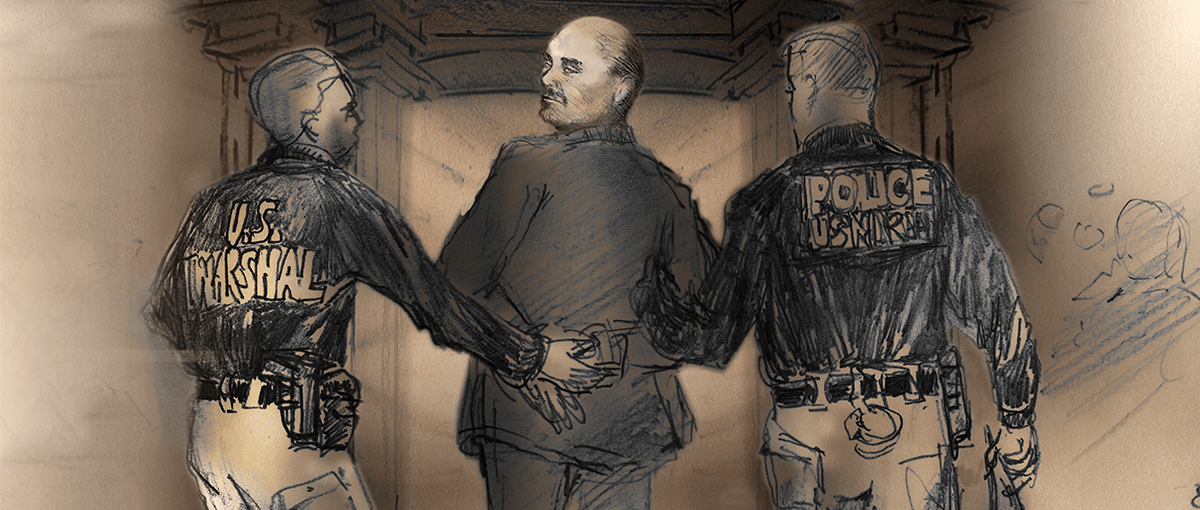

And after eleven years off the radar, a man resurfaces in Philadelphia, a man who used a computer model and the number pi in the nineties to predict economic turning points with astounding precision: Martin Armstrong predicted the exact date of the October crash in 1987, the demise of the Japanese bull market in 1990, the turning point for the US and European markets in July 1998 and the Nikkei crash in 1989. He was one of the wealthiest Wall Street market analysts and was named economist of the decade and fund manager of the year in 1998. But he refused to play along with the bankers’ game and warned his customers that “the club” was manipulating currency and silver markets. He quickly made powerful enemies: New York investment bankers, hedge funds managers, Salomon Brothers, Goldman Sachs. The FBI and SEC, US Securities and the Exchange Commission, started to show interest in his computer model. In 1999 he was arrested on charges of fraud which he still disputes to this day. He was incarcerated for seven years for contempt of court. After time in solitary confinement and threats against his mother, he signed a partial confession and was sentenced to a further four years.

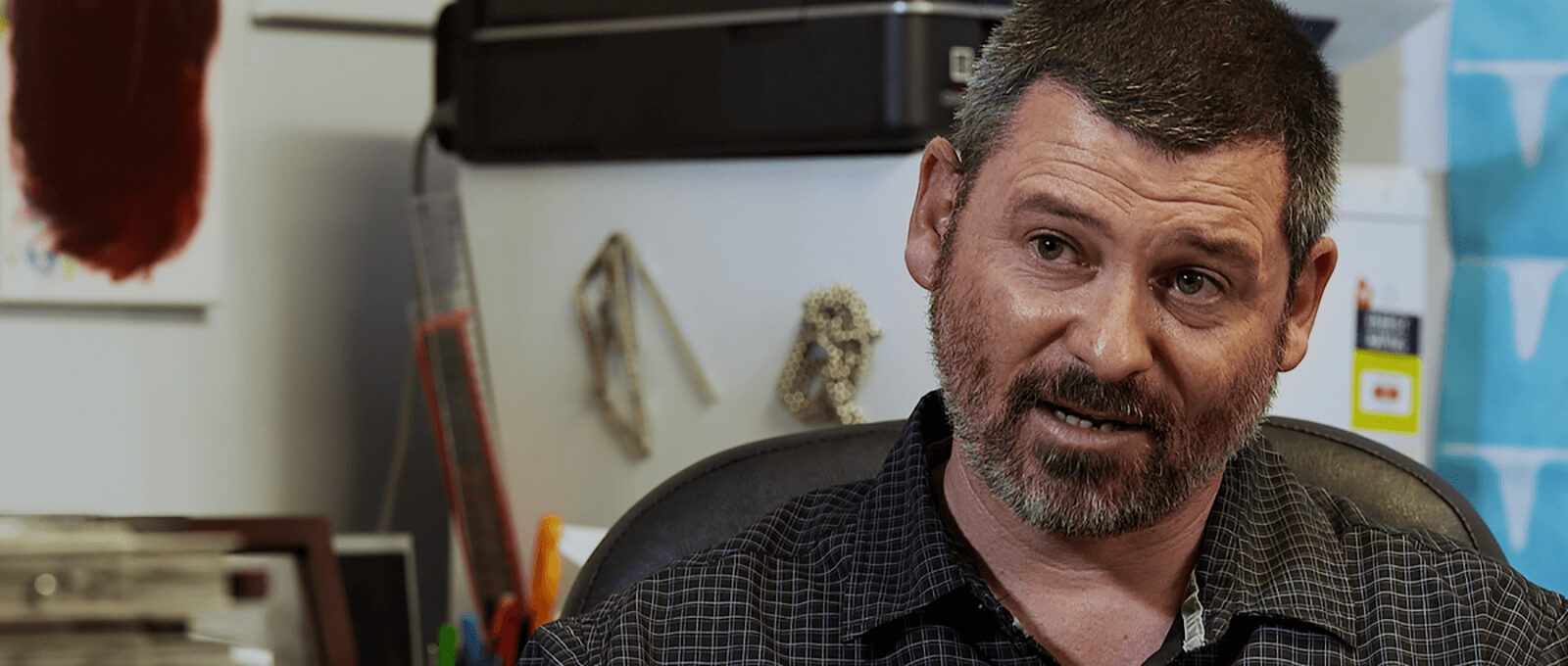

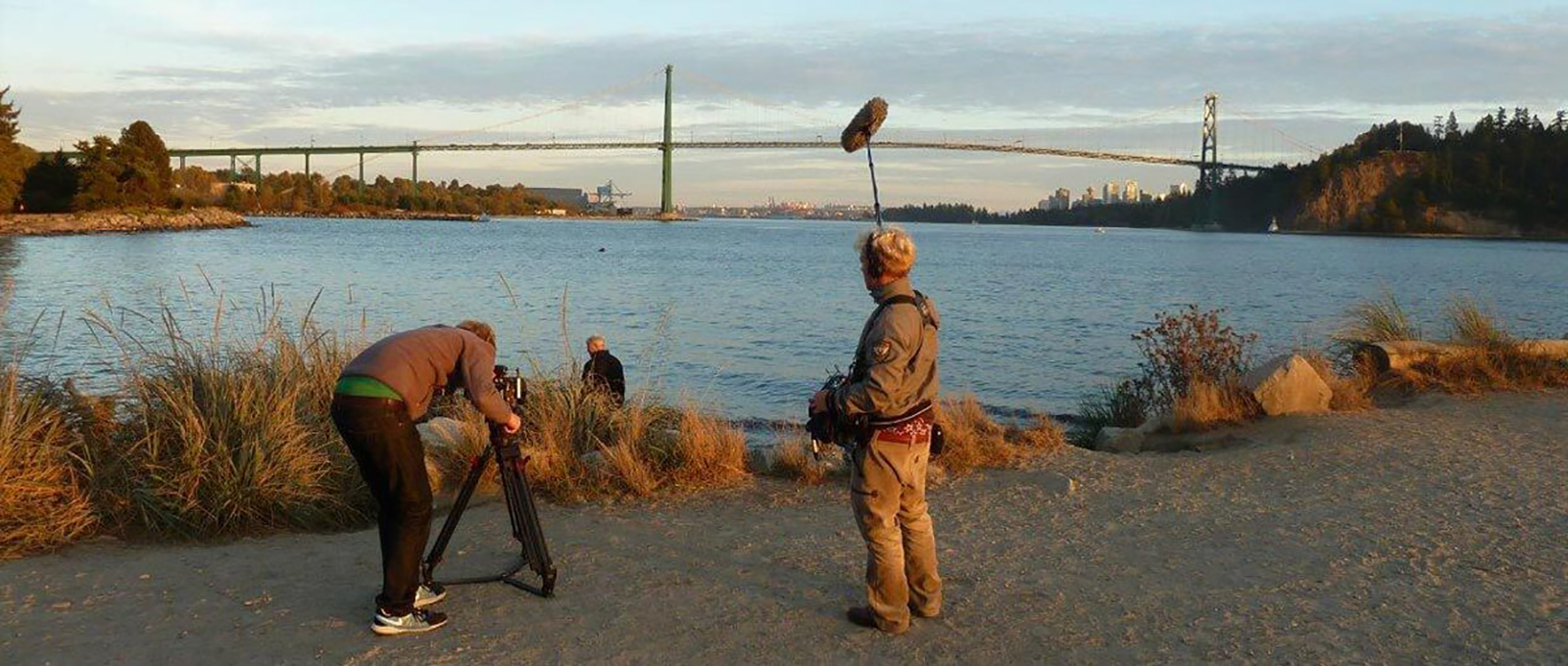

This documentary film portrays a man returning to his life after eleven years in prison. It follows him as he meets his old partners for the first time and depicts his first public speech to people who are still prepared to travel from across the globe and pay handsome sums to hear him speak. The film shows him attempting to prove his innocence and expose the power of the New York banks.

Martin Armstrong’s career thus began with a complete error of judgement. Even at this young age, he tried to understand the system, to grasp the logic according to which each boom was followed by a bust. Was Niccolo Machiavelli right in his belief that history repeated itself because man’s passions remain the same? He analysed the financial markets, studied the history of business cycles, stock market crashes and global monetary systems. He visited libraries and collected historical data: gold prices, exchange rates. He played around with figures and dates, he divided the time span between the Rye House Plot in 1683 and the year of the bankers’ panic in 1907 (224 years) by the number of market crashes during this period (26) and ended up with an average of 8.6

Eight point six – the global economy appeared to be based on this 8.6-year cycle. He multiplied the cycle by six which gave him 51.6 years and once again it all fitted perfectly: Black Friday in 1869, the commodity panic in 1920, and the Second and Third Punic Wars. He divided, subtracted and multiplied and established that 8.6 years equalled three thousand one hundred and forty-one days: 3,141, the magic number pi times a thousand. Did pi perhaps also govern the markets or the actions and moods that manifested themselves in these markets?

Armstrong was sure of one thing: there is a geometry of time. He may not be able to explain why, but there is some order to the chaos that exists around us.

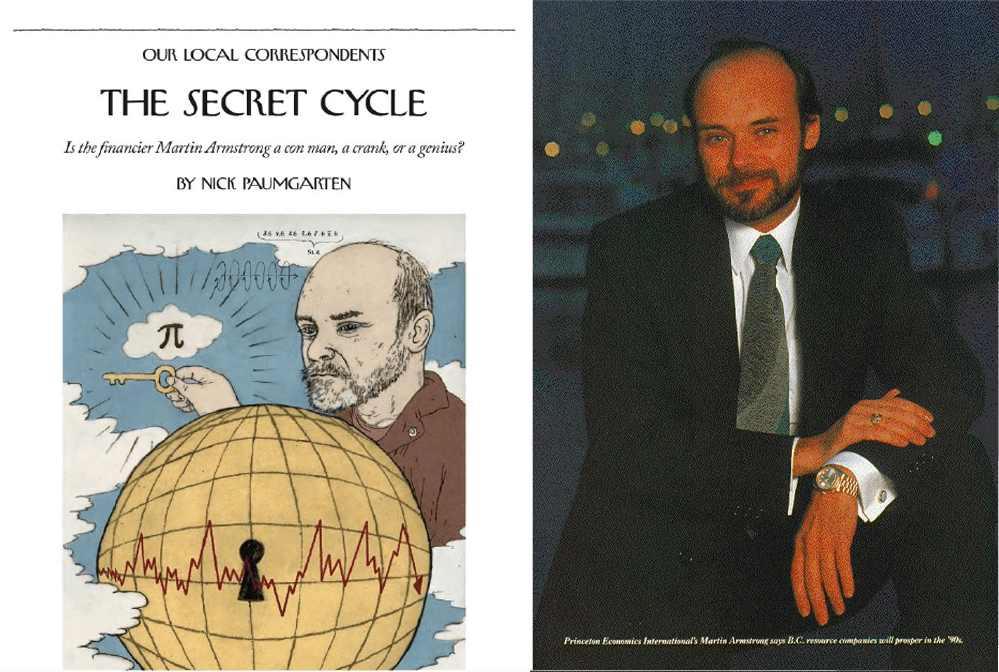

Martin Armstrong had just published the secrets of pi when FBI men stormed his office. Soon his accounts and those of his partners in London, Australia and Japan had been frozen. They were not to meet for twelve years. “Is financier Armstrong a Con man, a crank or a genius” asked the New Yorker headline in an eight-page article written as Armstrong was in a maximum security wing in New York. What are the judicial facts, the legal peculiarities and the juristic doubts involved here? And who could have profited from Martin Armstrong’s lengthy sentence behind US bars? And: what does all this say about a system on which we are all dependent in one way or another?

12 years after the demise of Princeton Economics Martin Armstrong is released from prison after he signed a coerced guilty plead. His new life commences with a “World Economic Conference” in Philadelphia. Only three months after his release, he’s back again. As if nothing had happened. As if there’d been no twelve years where he was deprived of the world. Martin Armstrong lectures to 350 people, who travelled especially to Philadelphia to see him. He speaks of his initial approach towards solving the global financial crisis, which he compares to the fall of the Roman Empire. And twelve years later, some of his former partners are back to perhaps resume operations where they’d left off. Will Martin Armstrong and his former partners join forces and re-establish Princeton Economics to make their distinctive mark on the desolate landscape of the financial sector?